UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

| | | | | |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under Rule 14a-12 |

|

| Trimble Inc. |

| (Name of registrant as specified in its charter) |

|

(Name of person(s) filing proxy statement, if other than the registrant): N/A |

|

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

Transforming

The Way

TheWorld

Works

| | | | | | | | | | | | | | |

| 2024 | | | | |

| | | | |

| | | | |

| | | | TRANSFORMING

The Way The

World Works

2023 NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | |

| | |

Trimble – Transforming the Way the World Works |

Trimble is a leading technology solutions provider that enables office and mobile professionals to connect their workflows and asset lifecycles to drive a more productive, sustainable future. With a focus on the industries that feed, build, and move the world, the comprehensive depth and breadth of our solutions is transforming the way the world works, making it easier for Trimble customers to focus on what matters—getting the job done right. We innovate at the intersection of the digital and physical worlds with solutions that span the world’s foundational industries including building, civil and infrastructure construction, geospatial, survey and mapping, agriculture, natural resources, utilities, transportation, and government. We exist to empower our customers: asset owners, general and specialty contractors, engineers and designers, surveyors, agricultural companies and farmers, energy and utility companies, trucking companiesshippers and drivers,carriers of freight, as well as state, federal, and municipal governments. Productivity and sustainability are at the heart of who we are—it’s woven into our work internally and through our customers’ application of our technologies. The state of the world today requires us to step up with an accelerated focus on ouradopt a strategic approach to manage the environmental, social, and governance (“ESG”)(ESG) aspects of our business. We have reduced our impact on the environment, we have improved employee engagement, and we are committed to maintaining the highest levels of transparency. These efforts will make us a better, more resilient company and motivate us to create greater sustainability solutions for thecontinue innovating, so our customers and stakeholders we serve.

|

TRIMBLE INC.

Notice of Annual Meeting of Stockholders

| | | | | | | | |

| | |

| | |

| When: | Where: | Who Can Vote: |

Thursday, June 1, 2023May 30, 2024 | Virtually via the internet at

| Stockholders of record at the close of business on: |

| 5:00 p.m. Mountain time | www.virtualshareholdermeeting.com/TRMB2023TRMB2024 |

| Online check-in: 4:45 p.m. Mountain time | | April 3, 20231, 2024 |

Items of Business and Board Voting Recommendations

| | | | | | | | |

| 1 | Election of directors | FOR each of the nominees |

| 2 | Advisory vote to approve executive compensation (“Say on Pay”) | FOR |

| 3 | Advisory vote on the frequency of holding a “Say on Pay” vote | 1 year |

4 | Ratification of appointment of independent registered public accounting firm | FOR |

| 4 | Approval of amendments to the 2002 Stock Plan | FOR |

Your Vote is Important

All stockholders are cordially invited to attend the Annual Meeting via the internet. Instructions on how to participate in the Annual Meeting and demonstrate proof of stock ownership are posted at the internet link shown above. However, to ensure your representation at the meeting, you are urged to vote in advance of the meeting via the internet or by telephone or, if you requested to receive printed proxy materials, by mailing a proxy.

A notice of internet availability of proxy materials (“Notice”) containing instructions on how to vote and how to access our Annual Meeting materials, including our proxy statement, our annual report and proxy card was mailed to our stockholders (other than those who previously requested electronic delivery or full printed materials) on approximately April 18, 2023.16, 2024. The Noticenotice of internet availability also included instructions on how to receive a paper copy of our Annual Meeting materials.materials, which include this notice of annual meeting and proxy statement and our annual report on Form 10-K. If you received a paper copy of our Annual Meeting materials by mail, the notice of Annual Meeting, proxy statement, anda proxy card from our Board of Directors werewas also enclosed. If you received your Annual Meeting materials via e-mail, the e-mail contained voting instructions and links to the notice and proxy statement and our annual report and the proxy statement on the internet, which are both also available at investor.trimble.com/annuals-and-proxies.

For the Board of Directors,

ExecutiveBörje Ekholm, Chairperson of the Board

April 18, 202316, 2024

TRIMBLE INC.

Proxy Statement

for the 20232024 Annual Meeting of Stockholders

Table of Contents

| | Introduction | Introduction | | Executive Compensation | |

| | |

| | |

| | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | |

| Proposals | | Proposals | | | | | |

| | | | | | | | | |

| | |

| | | | |

| | | | |

| | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | Other Information | |

| | | | Other Information | |

| | | | Other Information | |

| Board Matters | |

| Board Matters | |

| Board Matters | | | | | | |

| | | | | | | | | |

| | | |

| | |

| | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | |

| | |

| | |

| | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | |

| | | | | | |

| | | | | |

| | | | | |

| | |

| | | | | |

| | |

| Proposals | | | |

| | | | | |

| | | |

| | |

| | | | | |

| | |

| | | | | |

| | Other Information | |

| Board Matters | | | |

| | | | | |

| | | | | | |

| | | | | |

| | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | |

| | |

| | |

| |

INFORMATION REGARDING THE MEETING

The enclosed proxy is solicited on behalf of the board of directors (“Board of Directors” or “Board”) of Trimble Inc., a Delaware corporation (“Trimble” or the “Company”), for use at the Company’s annual meeting of stockholders (“Annual Meeting”), to be held live via the internet, on June 1, 2023,May 30, 2024, at 5:00 p.m. Mountain time, and at any adjournment(s) or postponement(s) thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The record date for the annual meetingAnnual Meeting is April 3, 20231, 2024.

You will not be able to attend the Annual Meeting in person. Any stockholder can listen to and participate in the Annual Meeting live via the internet at www.virtualshareholdermeeting.com/TRMB2023TRMB2024. Our Board annually considers the appropriate format of our annual meeting. In 2023,2024, we will only be hosting the Annual Meeting via live webcast on the internet. Hosting the Annual Meeting via the internet provides expanded access, improved communication, reduced environmental impact and cost savings for our stockholders and the Company. Hosting a virtual meeting also enables increased stockholder attendance and participation since stockholders can participate and ask questions from any location around the world, and provides us an opportunity to give thoughtful responses. In addition, we intend that the virtual meeting format provide stockholders a similar level of transparency to the traditional in person meeting format and we take steps to ensure such an experience. Our stockholders will be afforded the same opportunities to participate at the virtual Annual Meeting as they would at an in person annual meeting of stockholders.

Our virtual Annual Meeting allows stockholders to submit questions and comments during the meeting. After the meeting, we will spend up to 15 minutes answering stockholder questions that comply with the meeting rules of conduct; the rules of conduct will be posted on the virtual meeting web portal. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition.

The Annual Meeting webcast will begin promptly at 5:00 p.m. Mountain time. We encourage you to access the Meeting webcast prior to the start time. Online check-in will begin, and stockholders may begin submitting written questions, at 4:45 p.m. Mountain time, and you should allow ample time for the check-in procedures.

The webcast of the Annual Meeting will be archived for one year after the date of the Annual Meeting at www.virtualshareholdermeeting.com/TRMB2023TRMB2024.

Proxy Statement for the 20232024 Annual Meeting of Stockholders | Trimble 1

EXECUTIVE OVERVIEW

This overview highlights information about the Company, including certain information contained elsewhere in this proxy statement, but does not contain all of the information that you should consider. You should read the entire proxy statement carefully before voting. For more complete information regarding the Company’s performance in fiscal year 20222023 (“fiscal 20222023” or “20222023”), please review the Company’s Annual Reportannual report on Form 10-K for the year ended December 30, 2022.29, 2023.

Our Business

Dedicated to the world's tomorrow, Trimble is an industriala technology company transforming the way the world works by delivering solutions that enable our customers to thrive.work in new ways to measure, build, grow and move goods for a better quality of life. Core technologies in positioning, modeling, connectivity and data analytics connect the digital and physical worlds to improve productivity, quality, safety, transparency and sustainability. From purpose-built products toand enterprise lifecycle solutions to industry cloud services, Trimble is transforming critical industries such as agriculture, construction, geospatial, agriculture and transportation.transportation to power an interconnected world of work.

Company Performance Highlights

Fiscal 2023

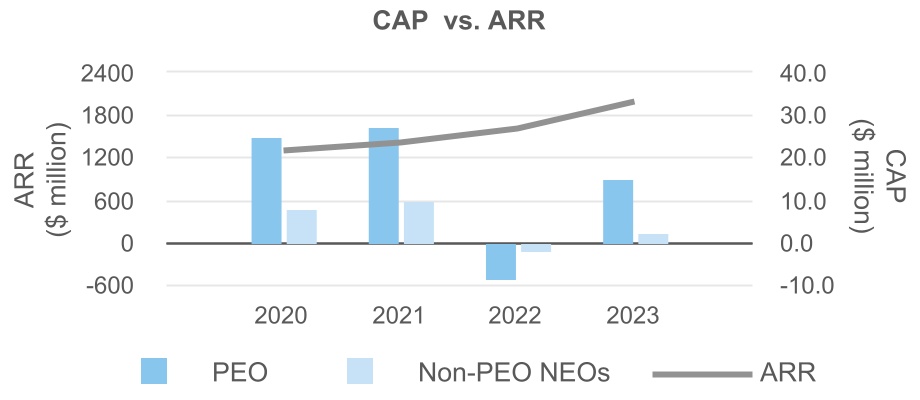

Our core strategy, Connect & Scale, involves digitally connecting the workflows within targeted industry segments and creating scale across Trimble through shared technology platforms. In 2022,2023, we managed to achieve record levels of revenue and annual recurring revenue (“ARR”) and to increase our gross profit margin. Compared to the prior year, revenue was up $17.2 million, ARR for the fourth quarter was up $194.6 million, and gross profit margin rose 1.7 percentage points. We continued to advance our Connect & Scalethis strategy, investing in people, process, and technology. We divested a number of businesses that are not core to our Connect & Scale strategy, and we acquired or entered into acquisition agreements with, companies that will accelerate our Connect & Scale strategy.strategy, including Transporeon. We also continued to develop the competitive strengths of our core businesses, while focusing on a healthy balance for our business portfolio with respect to end-market exposure, geographic diversity, and business model mix. Our ongoing strategy is to connect stakeholders across industry lifecycles and to transform customer workflows.

We achieved a record level of annualized recurring revenue (“ARR”) in 2023 and increased our gross profit margin. We finished 2022the year with software, services, and recurring revenues representing 59%67% of total Company revenue. We reached $1.60$1.98 billion in ARR in the fourth quarter of the year, up 14%24%, or 16%13% on an organic basis, compared to the fourth quarter of the prior year. Compared to 2021,2022, total revenue was flat, but grew 7%3%, or 1% organically, GAAP gross margin rose from 57.3% to 61.4%, and non-GAAP gross margin rose from 58.3%60.0% to 60.0%64.7%. We repurchased $395$100 million of common stock in 2022.2023. See Appendix A to this proxy statement for definitions of annualized recurring revenue and organic revenue growth.growth and a reconciliation of GAAP to non-GAAP numbers.

2 Trimble | Proxy Statement for the 20232024 Annual Meeting of Stockholders

Financial highlights for 20222023 included:

| | | | | | | | | | | |

| 2023 | 2022 | Change vs. 20212022 | Notes |

| Total revenue | $3.683.80 billion | Up modestlyp 3%

| Organic growth p 7%1% |

| Software, services and recurring revenue | 59%67%

of total revenue | p vs. 55%59% in prior year | |

| Annualized recurring revenue | $1.601.98 billion for the fourth quarter | p 14%24% compared to fourth quarter of prior year | Organic growth p 16%13% compared to fourth quarter of prior year |

NetOperating income | $450449 million GAAP | q 9%12% | 12.2%11.8% as a % of GAAP revenue

vs. 13.5%13.9% in prior year |

| $660935 million non-GAAP | qp 2%11%

| 18.0%24.6% as a % of non-GAAP revenue vs.18.5%22.9% in prior year

|

| Adjusted EBITDA | $917 million1.01 billion | qp 2%10%

| 25.0%26.6% as a % of revenue

vs. 25.6%25.0% in prior year |

| | | |

| | | |

OperatingNet income | $511311 million GAAP | q 9%31% | 13.9%8.2% as a % of GAAP revenue

vs. 15.3%12.2% in prior year |

| $842664 million non-GAAP | qp 2%1%

| 22.9%17.5% as a % of non-GAAP revenue

vs.23.4%18.0% in prior year |

| Diluted net income per share | $1.801.25 GAAP | q vs. $1.941.80 in prior year | |

| $2.642.66 non-GAAP | qp vs. $2.662.64 in prior year

| |

| Operating cash flow | $391597 million | qp vs. $751391 million in prior year

| |

| Repurchase of common stock | $395100 million | | $180395 million in prior year |

See Appendix A to this proxy statement for a reconciliation of GAAP to non-GAAP financial measures,

Proxy Statement for including operating income and net income (as also used in the 2023 Annual Meetingcomputation of Stockholders | Trimble 3

diluted net income per share), along with definitions of organic revenue growth, annualized recurring revenue, and adjusted EBITDA. Long-term performance

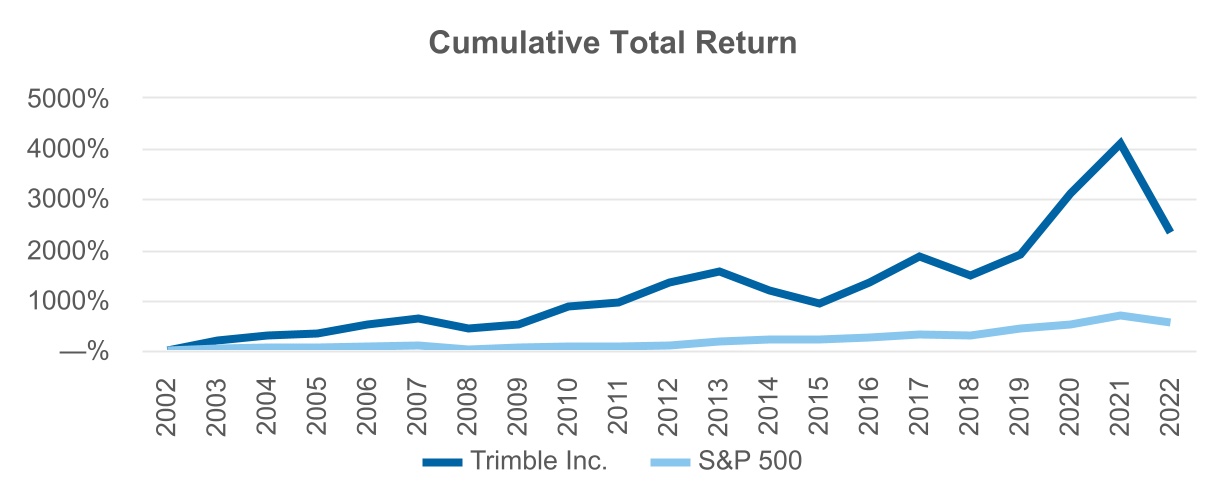

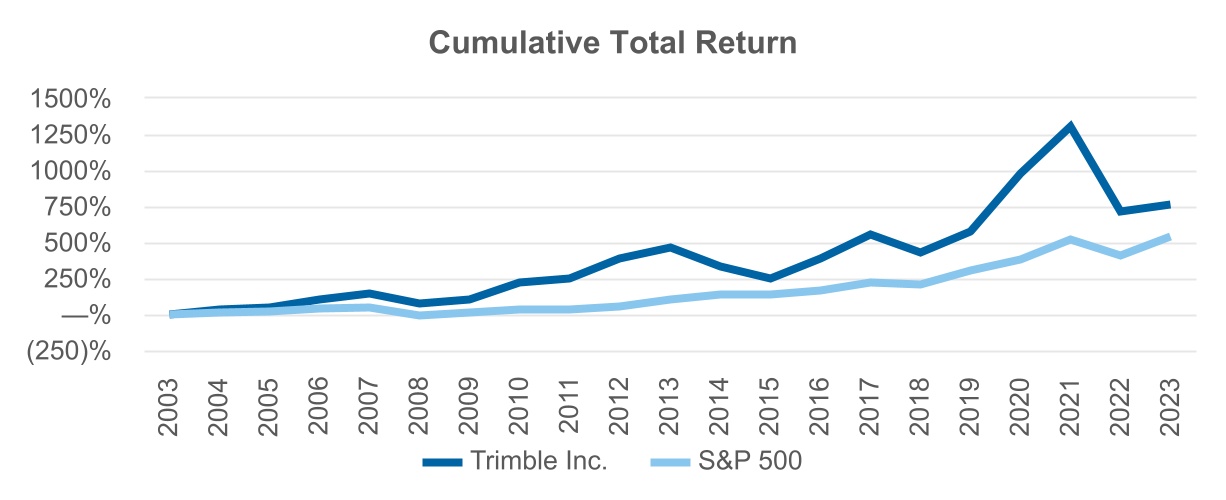

Since 2011,2013, Trimble’s revenue, annualized recurring revenue, GAAP operating income, and adjusted EBITDA have grown at compound annual growth rates of 8%5%, 15%13%, 6%, and 10%7%, respectively, illustrating the company’s long-term growth trajectory over time. In addition, Trimble has demonstrated a strong record of performance and creating stockholder value over an extended period of time, as shown in the following table of average annual increase in stock price:

| | | | | | | | | | | | | | | | | | | | |

| 1 year | 3 years | 5 years | 10 years | 15 years | 20 years |

| Trimble | (42.1)% | 6.6% | 4.5% | 5.4% | 8.4% | 17.3% |

| S&P 500 (TR) | (18.2)% | 7.7% | 9.4% | 12.6% | 8.8% | 9.8% |

In addition,Also, as shown in the graph below, Trimble's cumulative total return has outperformed the S&P 500 over the 20-year time horizon.

Proxy Statement for the 2024 Annual Meeting of Stockholders | Trimble 3

Long-term growth strategy

Elements. Our growth strategy is centered on multiple elements:

Executing on ourOur Connect & Scale strategy. We continue to focus on executing our multi-year platform strategy, which contains two elements. The first element, Connect,, aims to connect more customer workflows, industry life cycles,lifecycles, and solution offerings, so that we can continue to transform the way our customers work. This includes integrating more of our customers’ data through cloud offerings and making more of our solutions available over time on a subscription basis. When end users interact on aFor example, our flagship design and construction platform solution, Trimble Connect, enables entire project teams to collaborate in real-time between the office and the field to make efficient decisions around the same data-rich design model enhanced by our cloud capabilities. The second element, Scale raises the bar with shared, online platform, the overallon-demand services that empower network participants to proactively contribute to value that is created increases ascreation and delivery, directly and with fewer intermediaries. As the number of end-user participants increases. This network effect means thatend users increases, the willingness of developers, partners, orand additional end users to engage also increases, as the number ofcreating a network participants grows, whicheffect that further enhances the platform experience and end-user value. The second element, Scale, also aims to invest in the people, processes, and technologies that are necessary to streamline and standardize our internal processes, provide a seamless experience for our customers as they engage with our connected solutions, and enable us to continue to grow our business efficiently and effectively for many years into the future.

Increasing our focusFocus on software and services. Software and services targeted for the needs of vertical end markets are increasingly important elements of our solutions and are core to our growth strategy. We generally have an open application programming interface philosophy and open vendor environment, which leads to increased adoption of our software and analytics offerings. These software and services solutions integrate and optimize additional workflows for our customers, thereby improving their work productivity, and in the case of subscription, maintenance, and support services, also provide us with enhanced business visibility over time.Professional services constitute an additional customer offering that helps our customers integrate and optimize the use of our offerings in their environment.

Focusing onTargeting attractive markets with significant growth and profitability potential. We focus on large markets historically underserved by technology that offer significant potential for long-term revenue growth, profitability, and market leadership. Our core industries, such as construction, agriculture, and transportation, are each multi-trillionmultitrillion dollar global industries that operate in demanding environments with technology adoption in the early phases relative to other industries.

4 Trimble | Proxy StatementWith the emergence of mobile and cloud computing capabilities, the increasing technological know-how of end users, and compelling return on investment, we believe many of our markets are attractive for the 2023 Annual Meetingsubstituting Trimble’s technology and solutions in place of Stockholderstraditional operating methods.

Investing in domainDomain knowledge and technological innovation that benefit a diverse customer base. We have over time redefined our technological focus from hardware-driven point solutions to integrated work process solutions by developing domain expertise and heavily reinvesting in research and development and acquisitions. We currently have over 1,000 unique patents reflective of our technology portfolio and deep domain knowledge to deliver specific, targeted solutions quickly and cost-effectively to each of the vertical markets we serve. Our patent portfolio is continuously updated with new patent grants that emerge from our investments in research and development. We look for opportunities where the potential for technological change is high and that have a requirement for the integration of multiple technologies into complete vertical solutions.

Implementing geographicGeographic expansion with a localization strategy. We view international expansion as an important element of our strategy, and we continue to position ourselves in geographic markets that will serve as important sources of future growth. Trimble products are sold in more than 150 countries, through dealers, joint ventures, original equipment manufacturers (“OEMs”), and other channels throughout the world, as well as direct sales to end users. Sales are supported by our own offices located in over 40 countries around the world.

Using optimizedOptimized go-to-market strategies to best access our markets. We utilize vertically focused go-to-market strategies that leverage domain expertise to best serve the needs of individual markets both domestically and abroad. These go-to-market capabilities include the use ofindependent dealers, joint ventures original equipment manufacturers,such as with Caterpillar and Nikon, arrangements with OEMs, and distribution alliances with key partners, as well as direct sales to end users, which providecollectively provides us with broad market reach and localization capabilities to effectively serve our markets.

Taking advantage4 Trimble | Proxy Statement for the 2024 Annual Meeting of strategic acquisitions.Stockholders

Strategic acquisitions, joint ventures, and investments. Organic growth continues to be our primary focus, while acquisitions serve to enhance our market position. We acquire businesses that bring domain expertise, geographic presence, technology, products, and distribution capabilities that augment our portfolio and allow us to penetrate existing markets more effectively, or to establish a market beachhead. Our success in targeting and effectively integrating acquisitions is an important aspect of our growth strategy. To further grow and position the Company, we partner with leaders in various fields by investing in early-to-growth stage companies through our venture fund and through strategic formation of joint ventures. In December 2022,September 2023, we signed a definitive agreement to acquire Transporeon for an aggregate purchase pricecontribute our Trimble precision agriculture (“OneAg”) business, excluding certain Global Navigation Satellite System (GNSS) and guidance technologies, to a joint venture with AGCO, of approximately €1.9 billion,which we will retain a 15% ownership stake. Trimble and AGCO’s shared vision is to create a global leader in mixed fleet smart farming and autonomy solutions that delivers on our collective strategy to better serve farmers with factory fit and aftermarket applications in the mixed fleet precision agriculture market. The transaction was completedclosed on April 3, 2023. Transporeon, a Germany-based company, is a leading cloud-based transportation management software platform that connects key stakeholders across the industry lifecycle to positively impact the optimization of global supply chains, in alignment with our Connect & Scale and sustainability strategies.1, 2024.

Accelerating innovation through venture fund investments. We formed a strategic venture fund in 2021, through which we expect to invest up to $200 million in early- to growth-stage companies that can accelerate innovation and effectively bring new solutions to our customers and the industries that we serve and can give us an early, inside look and stake in emerging business and technology solutions.

Delivering on sustainability.Sustainability. The global economy is experiencing a fundamental shift toward sustainability, driven through broad stakeholder engagement, with a focus on decarbonization. Throughout Trimble’s history, byHistorically, through delivering productivity and efficiency gains, ourTrimble products have delivered sustainability for our customers, and we envision more opportunities to deliver expanded carbon reductions and other sustainability benefits, such as water management in agriculture and utilities.

Guiding principles. To achieve Trimble’s long-term strategy, the company’s core principles guide our employees’ actions and behaviors and support the Connect & Scale strategy:

•Our operating system focuses on Strategy, People and Execution to create a high-performing organization.

•Our guiding values of “Be yourself and thrive together,” “Be intentional and humble,” and “Be curious and solve problems,” are the central, underlying philosophies that guide our interactions with each other and how we do business.

•Our guiding principles help us navigate and manage inherent complexities with ethical integrity, respect and teamwork.

•Our leadership principles drive us to inspire purpose and vision, engage to draw out the best from each other, and strive to achieve meaningful results.

Our Strategy for Sustainability

Overview

We recognize that we are shaping a sustainable future by living in a timeour values and working towards our mission of increasing urgency for action on sustainability, and we are moving quickly and harnessing our potential to address global challenges. Inspired by our mission—“Transforming the Way the World Works”—. Inspired by our mission, and fueled by the dedication of our employees, we work to build momentum and strive for continual improvement and measurable progress. We believe our efforts, and the focus of our Board on Environmental, Social,environmental, social, and Governance (ESG)governance (“ESG”) issues, will make us a better and more resilient company, positioned to take on our most pressing environmental and social issues while creating even greater benefits for the customers and stakeholders we serve.

The Board ultimately oversees sustainability and ESG strategy, although each standing committee of the Board addresses various ESG matters and the charter of the Nominating and Corporate Governance Committee includes oversight regarding the Company’s strategies, programs, initiatives and policies for ESG matters. In fulfilling this role, the Nominating and Corporate Governance Committee engages with management on such matters, and develops and recommends to the Board corporate governance principles applicable to the Company and oversees the implementation of these principles.

Proxy Statement for the 20232024 Annual Meeting of Stockholders | Trimble 5

Sustainability Strategy

Sustainability is deeply integrated into our business strategy, threaded throughout our products and solutions and our people and culture. It’s what guides our innovations and investments. It’s what drives us to build resilience for our company and our customers, to empower people, including our employees and partners, and to lead with integrity in all that we do.

| | | | | | | | | | | | | | |

Building Resilience •Drive, Enable, and Contribute to Decarbonization •Drive toward a net-zero future | | Empowering People •Values: Belong, Grow, and Innovate •Key Pillars: Diversity, Equity, Inclusion, Leaders, and Communities | | Leading with Integrity •Corporate and Sustainability Governance •Ethical Business Practices •Privacy and Cybersecurity |

Building Resilience. Building resilience is about enabling ourselves, our customers, and the essential industries we serve to adapt, grow, and thrive in the face of change. We organizecontinue to invest in innovation, research, and development in order to adapt, prepare, and expand capabilities that help transform our ESG efforts around five pillars: industries and accelerate toward a net zero future. In 2022, we received approval of our carbon reduction targets from the Science Based Targets initiative (1) Solutions, (2) People, (3) Communities, (4) Environment,“SBTi”), the predominant third-party net-zero target assessment entity. Our goals are consistent with requirements to keep global warming to 1.5°C in accordance with the Paris Climate Agreement.

Empowering People. Together, our diverse community of innovators and (5) Governance. These pillars are reflective ofproblem solvers creates opportunities for our employees, customers, and community members to thrive. We extend our commitment to ESGempowering people in the communities where we do business, collectively addressing challenges in alignment with our values. As further described below in “Our Culture and People,” we are fundamentally embedded into our businessfocused on building a welcoming, diverse, equitable, and culture.inclusive workplace. We believe this approach creates valueour diversity makes us stronger and better able to solve complex problems for our customers.

Leading with Integrity. We are dedicated to leadership principles that benefitsensure excellence in all our stakeholders, including our employees, stockholders, customers, communities,we do. Through transparency, good governance, and a deep commitment to sustainability and ethics, we continue operating from a strong foundation of integrity now and in the world at large.future.

| | | | | | | | | | | |

| Our Solutions. Our hardware, software, and service solutions empower customers to drive sustainability across our industries for the benefit of people today and future generations. We are committed to ensuring our solutions align with and support the objectives of the 17 United Nations Sustainable Development Goals (“UN SDGs”). Our industry-specific solutions impact the UN SDGs by:

• Greenhouse gas reduction via (i) efficient use of machine time on construction sites, (ii) better construction design to minimize carbon intensive materials and improve asset operations, (iii) improved long-term asset management to extend the life of assets, (iv) more efficient field navigation and utilization of agricultural inputs, and (v) improved capacity utilization and route optimization that reduces fuel use;

• Resource management via (i) protecting and managing critical water assets and infrastructure, (ii) helping minimize scrap, rework, and resource waste, and (iii) managing land, water and inputs through variable rate technology and land forming solutions.

| |

Our People. Our ambition for a sustainable future is made possible when we celebrate the unique characteristics of our people. At Trimble, we transform how we work together to inspire and engage all employees to achieve their full potential and celebrate their individuality. We are focused on building a welcoming, diverse, equitable, and inclusive workplace. We are committed to providing every employee with the opportunity to learn, grow, and excel. We believe our diversity makes us stronger and better able to solve complex problems for our customers.

| Environment. We are committed to decarbonization and a net zero future. We live this commitment within our operations and value chain, which is reflected in our science-based targets. We help impact this transition through our products and services that generate productivity and efficiency gains that can reduce customers’ GHG emissions.

|

Communities. We strive to contribute to the collective work needed to address the world’s most pressing sustainable development issues through partnering with non-profit organizations and academic institutions who serve communities and society in powerful ways. The Trimble Foundation Fund is a donor-advised fund that focuses its charitable giving across three areas—natural disaster recovery and relief and climate resilience; female education and empowerment; and advancing diversity, equity, and inclusion—while also supporting the philanthropic efforts of our local offices. In addition, we are partnering with educational institutions worldwide to democratize education and to ensure that future industries are accessible, equitable, and sustainable.

| Governance. We continue to enhance our sustainability program management and monitoring. Our sustainability team works under the supervision of our executive leadership team, with oversight by our Board, both of which fortify the governance and decision-making structure, while mitigating elements of risk. We have taken progressive measures to align business accountability with sustainability performance. Executive pay is in part linked to progress against climate action and diversity goals. We also secured a revolving credit facility that links to our sustainability commitment.

|

20222023 Sustainability Highlights — Progress on Climate Action

In 2022, the Science Based Targets initiative (“SBTi”) approved2023, Trimble made progress on fulfilling our near-term science-based emissions reduction targets, which are aligned with requirements to keep warming to 1.5°C,as approved by the most ambitious goal of the Paris Agreement.SBTi. The approved targets are as follows:

•Reduce absolute scopes 1 and 2 Greenhouse Gas (“GHG”) emissions by 50 percent by 2030 from a 2019 base year including achieving 100 percent annual sourcing of renewable electricity by 2025.

6 Trimble | Proxy Statement for the 2023 Annual Meeting of Stockholders

•Reduce absolute scope 3 GHG emissions (includes emissions from fuel and energy-related activities, business travel, and upstream transportation and distribution) by 50 percent by 2030 from a 2019 base year.

•Commit to partner with 70 percent of our suppliers by emissions covering purchased goods and services and capital goods to set science-based targets by 2026.

By completing our first report in alignmentDetails on Trimble’s emissions reduction progress and roadmap, along with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), Trimble has established another level of transparency and accountability around our management of climate-related risks and opportunities. This report details the robust governance and management oversight of climate-related issues that forms the cornerstone of Trimble’s overall approach to managing climate-related risks and opportunities.

More information regarding oversight of sustainability and other ESG matters by our Board and its committees is provided under “Board Meetings and Committees; Director Independence—Board Leadership Structure; Oversight and Risk Management” later in this proxy statement. Morefurther information about Trimble’s sustainability efforts, includingcan be found in our Sustainability Report, with a SASB index and our TCFD report, is available at:at www.trimble.com/en/our-commitment/overviewtrimble.com/sustainability. (The(The information on our website is not incorporated by reference in this proxy statement.)

6 Trimble | Proxy Statement for the 2024 Annual Meeting of Stockholders

Our Culture and People

Our culture reflects our guiding principles at work and is fundamental to sustaining our success. We believe thatThat company culture is foundational to a thriving workplace; it is the behaviors and values of leaders and employees that are the foundation tofor who we are. At Trimble, we value being yourself and thriving together; being intentional and humble; and being curious and solving problems. Our leaders inspire purpose and vision, engage to draw out the best from each other, and strive to achieve meaningful results. This mindset shapes how we treat one another and how we serve our customers, colleagues, and stockholders. These attributes serve as a common foundation across the global organization and also adapt locally to diverse geographic and operational business models. Commitment to these behaviors connects our employees.

To continue producing innovative technologies, it is crucial that we continue to attract, engage, develop, and retain top talent. This crucial outcome is supported through our continued effortsWe strive to make Trimble a diverse, equitable, inclusive, and safe workplace and provide opportunities for our employees to grow and develop in their careers.careers, supported by competitive compensation, benefits, health and wellness programs, and by programs that build connections between our employees and their communities.

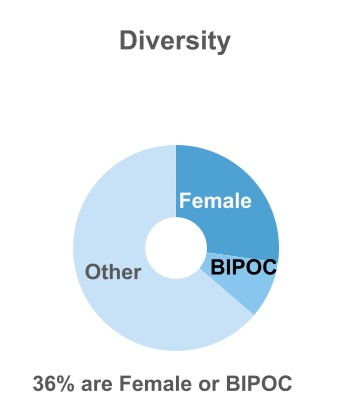

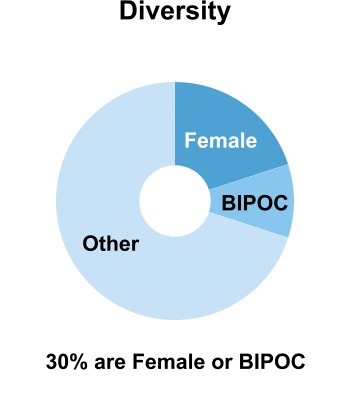

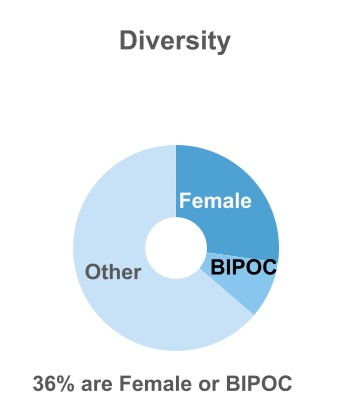

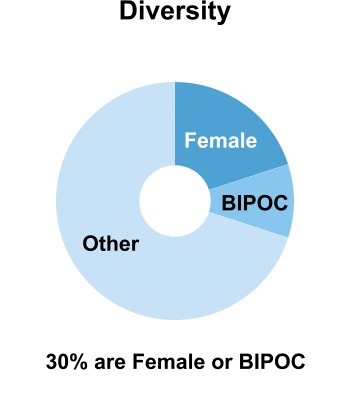

Diversity, Equity, and Inclusion (“(DEI“DEI””)

We value diversity in our workforce, including various cultures, backgrounds, ages, genders, races and ethnicities, nationalities, sexual orientations, religions, people with different abilities, parents and caregivers, and many other characteristics, knowing that it drives our best thinking. Our focus on diversity starts at the top. Our employees are working in around 200 locations in over 40 countries. Collectively, we speak more than 45 different languages. We believe our diversity makes us stronger and better able to solve complex problems for our customers.

Our focus on diversity starts at the top. Four Three out of our eleventen board members are female or ethnically diverse, and we are making progress to increasetowards our goal of increasing global female employees and U.S. ethnically diverse employees in our workforce and in our leadership positions across the company. We are focused on measuring

A number of employee resource networks exist in Trimble that enhance our inclusive and increasing gender representation, as well as racediverse culture, including networks that support women, caregivers, Black, Hispanic/Latinx and ethnic diversity in high-impact roles such as people leaders, engineeringIndian professionals, veterans, employees with disabilities, and technical positions, and sales.our LGBTQ+ community.

In 2022,2023, we made progress on many new initiatives focused on infusing diversity, equity, and inclusioncontinued our investments in the fabriccommunity partners by serving as a Board of our connected culture. We launched our second Renew Returnship program cohort that provides employment opportunitiesCorporate Affiliates sponsor for those who have taken a break in their careers to look after their families. We built new relationships with the National Society of Black Engineers, and became a sponsor tosponsoring Out & Equal, a non profitnon-profit organization working on LGBTQ+ workplace equality. We participatedequality, and increasing our presence at events like AfroTech and Colorado Technology Association’s Women in many new national and local diversity career fairs and sponsored engagements focused on increasing gender and race/ethnic diversity in the industries we serve through groups like Transportation and Construction Girl. We also increased our investments in education through new Trimble technology labs at Minority Serving Institutions and the Dr. Gladys West Scholarship Program, which honors a GPS technology pioneer and woman of color, and we award scholars at three universities serving underrepresented students.

Proxy Statement for the 2023 Annual Meeting of Stockholders | Trimble 7

More information about Trimble’s DEI efforts, including our 20212022 DEI Report with our 2025 goals, is available at: trimble.com/diversity-and-inclusion. www.trimble.com/en/our-commitment/people-and-planet/dei-overview. (The(The information on our website is not incorporated by reference in this proxy statement.)

Compensation and Benefits

We believe people should be paid for the role they perform and their skills and experience, regardless of their gender, race, age, or other personal characteristics. To deliver on that commitment, we benchmark and set pay ranges based on market data and individual factors such as an employee’s role, their experience, their performance, and region.the region in which they live. We also regularly review our compensation practices to ensure our pay is fair and equitable. In addition to base salaries, certain roles are eligible to participate in short-term and long-term incentive plans.

We offer market competitivemarket-competitive benefit programs (that vary by country/region), which include health and wellness benefits, life insurance and disability benefits, flexible savings accounts, paid time off, parental and family leave, employee support programs, retirement plans, and an employee stock purchase plan. Other benefits include fertility, adoption, and surrogacy education assistance; gender affirmation, family and caregiver support; flexible work arrangements; education assistance; and on-site services such as health centers and fitness centers at some sites.

Talent Development and Building Connections

We are committed to providing every employee with the opportunity to learn, grow, and excel in a respectful and collaborative workplace. We launched new career growth and development initiatives in 2022 toThrough our internal global talent platform, we empower employees to identify internal job opportunities, skill development resources, and projects to achieve their personal development goals and full potential. We encourage employees to nurture a love of continuous learning and resilience that is essential for accomplishment.

Building ConnectionsProxy Statement for the 2024 Annual Meeting of Stockholders | Trimble 7

We believe that building connections between our employees, their families, and our communities creates a more meaningful, fulfilling, and enjoyable workplace. SinceIn our employees are passionate about a varietyoffices around the world, our employee-led committees select local organizations to support, often in the form of causes, our company givinggrants and volunteering programs support and encourage employees by engaging with those causes. We also encourage and provide our employees with a day of service as a benefit to help our communities.employee fundraising.

Our Trimble Foundation Fund aligns international philanthropic efforts by giving back to the communities where Trimble does business and helping those in need. We do this by supportingThe Trimble Foundation Fund focuses on three focuskey areas disasterwithin our communities (i) Disaster and climate resilience; female educationClimate Resilience, (ii) Female Education and empowerment;Empowerment, and DEI, as well as by supporting the philanthropic efforts of our local offices.(iii) Advancing Diversity, Equity, and Inclusion.

Health, Safety, and Wellness

The success of our business is fundamentally connected to the well-being of our people. Accordingly, we are committed to the health, safety, and wellness of our employees. We provide our employees and their families with access to a variety of innovative, flexible, and convenient health and wellness programs including benefits that provide protection and security so they can have peace of mind concerning events that may require time away from work or that impact their financial well-being; that support their physical and mental health by providing tools and resources to help them improve or maintain their health status and encourage engagement in healthy behaviors; and that offer choice where possible, so they can customize their benefits to meet their needs and the needs of their families.

In response to the Covid-19 pandemic, we implemented changes that we determined were in the best interest of our employees, as well as the communities in which we operate, and which comply with government regulations. As Covid-related lockdowns subsided, we are supporting employees in transition to return to office and flexible working arrangements.

Corporate Governance Highlights

Corporate Governance Framework

Our Board recognizes that Trimble’s success over the long term requires a strong corporate governance framework. Below are highlights of our corporate governance framework:

•Our directors are elected annually.We actively engage our stockholders for feedback.

•We separaterecently adopted an amendment to our bylaws to adopt a majority voting standard for the positionselection of Executive Chairperson of the Board, CEO and Lead Independent Director, which providesdirectors, changed from a balance in our leadership structure and helps ensure a strong, independent and active Board.plurality voting standard (contested elections will continue to be governed by plurality voting).

•In uncontested elections,the recent amendment of our directors must be elected bybylaws, we added a majority of the votes cast, and an incumbent director who fails to receiveprovision giving stockholders a majority is required to tender his or her resignation.proxy access right.

8 Trimble | Proxy Statement for the 2023 Annual Meeting of Stockholders

•We have no supermajority voting requirementsrequirements.

•Our Board of Directors has an independent chairperson (since the retirement of Steve Berglund in May 2023, and the subsequent appointment of Börje Ekholm as chairperson).

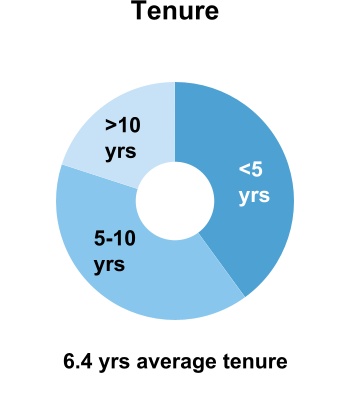

•We focus on board refreshment and diversity. More than half of our Certificatedirectors have less than five years of Incorporation current tenure and a third of our directors are female and/or Bylaws.ethnically diverse.

•We have stock ownership guidelines for our non-employee directors (and a stock ownership policy applicable to our executive officers, including our CEO).

•We have established a succession planning process and we actively plan for executive succession on an ongoing basis, as demonstrated by the successful transition of both our new CEO and CFO into their roles in 2020.basis.

•We have double triggerno single-trigger full vesting arrangements upon a change in control, arrangements for new equity issuances, withand no excise tax gross‑up.

•We have stock ownership guidelinesThe Board of Directors has overall responsibility for our non-employee directors and a stock ownership policy applicable to our executive officers, including our Named Executive Officers.the oversight of risk management for the Company.

•We actively engage our stockholders for feedback.The Board of Directors oversees cybersecurity risk at the Company, with the Audit Committee receiving regular updates on cybersecurity risk management.

•We focus on board diversityOversight of the Company's financial matters and refreshment,related risks lies with the Audit Committee.

•In setting compensation, our People & Compensation Committee considers the risks to our stockholders and the Company as evidenceda whole.

•The Company's corporate governance principles are overseen by the fact that four outNominating and Corporate Governance Committee and set forth in our publicly available Corporate Governance Guidelines.

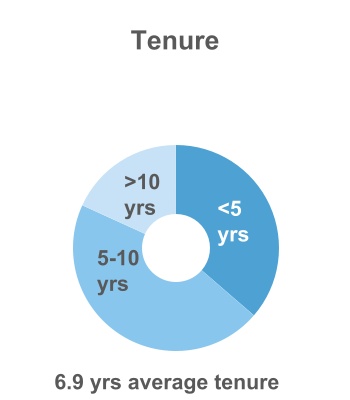

Board Diversity

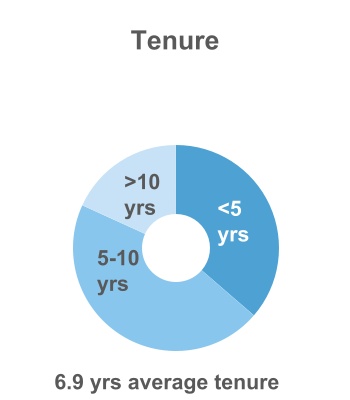

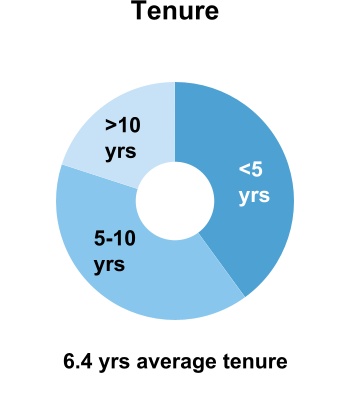

Our Board strives to maintain a diversity of elevenmembership. The composition of our Board was affected in the past year by the resignation of Ann Fandozzi, who left the Board in February of this year to spend more time in her new role as CEO of Convergint, and the death of Sandra MacQuillan, who passed away in April 2023, in addition to the retirement of Steven Berglund, who retired from the Board and from his executive role with the Company, effective as of the Company’s 2023 annual meeting of stockholders. Earlier this year, the Board appointed Kara Sprague and Ron Nersesian to serve as directors, are female or ethnically diverse (black, indigenouswho both joined the Board effective February 5, 2024. The Board Diversity Matrix set forth below provides information as of April 1, 2024 (for purposes of the matrix and peoplesrelated chart, tenure includes both current service and any previous service on the Board). To view our Board Diversity

8 Trimble | Proxy Statement for the 2024 Annual Meeting of color, or Stockholders

Matrix as of April 1, 2023, please see our prior proxy statement filed with the U.S. Securities and Exchange Commission (the “BIPOCSEC”), and four out of eleven of our directors have less than five years of tenure.) on April 18, 2023.

| Board Diversity Matrix | | Board Diversity Matrix as of April 1, 2024 | | Board Diversity Matrix as of April 1, 2024 |

| Total Number of Directors: | Total Number of Directors: | 11 | Total Number of Directors: | 10 |

| Diversity | Diversity | Female | Male | Diversity | Female | Male |

| Gender Identity | 3 | 8 |

| Demographic Background: | |

| African American or Black | 0 | 1 |

| | White | 3 | 7 |

| Gender Identity | | | Gender Identity | 2 | 8 |

| Demographic Background: | |

| | African American or Black | |

| | African American or Black | |

| | African American or Black | | 0 | 1 |

| | White | | | | White | 2 | 7 |

| Tenure | Tenure | |

| <5 years | 4 |

| 5-10 years | 5 |

| >10 years | 2 |

| <5 years | |

| <5 years | |

| <5 years | | 4 |

| 5-10 years | | | 5-10 years | 4 |

| >10 years | | | >10 years | 2 |

We believe that our directors are highly qualified and well suited to providing effective oversight of our continuously evolving business, and that they provide our Board with a balance of critical skills and an effective mix of experience and expertise, as summarized below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Skills & Attributes | Number of Directors |

| | | | | | | | | | | | |

| Leadership | Demonstrated understanding of essential leadership qualities; ability to develop leadership potential in others and effectively implement transformational change within organizations | | | | | | | | | | | 1110 |

| Innovation | Experience with innovative technologies and their development and deployment; understanding of relevant technological trends and their disruptive potential | | | | | | | | | 9 | | | | | | | | | | 11

|

| Domain Expertise | Understanding of the industries we serve, including market dynamics, customer workflows, and developing trends

| | | | | | | 75 | | | | | |

| Global Business | Experience with international dynamics and complexity, multinational operations, and the development of international relationships and opportunities | | | | | | | | | 98 | | |

| Go To Market | Understanding how to optimally bundle, launch, market and distribute new solutions to deliver compelling value to customers | | | | | | 6 | | | | | |

| Financial Expertise | Knowledge of financial accounting and reporting, financial markets, and finance operations and management, including capital deployment | | | | | | | | 86 | | | | |

| Strategic Transactions | Familiarity with driving business transformation through M&A, strategic alliances, investments, and significant commercial partnerships | | | | | | | | 86 | | | | |

| Sustainability | Experience with ESG initiatives, frameworks and trends, including long-term sustainability and value creation, diversity and inclusion, or public company governance oversight | | | | | | | | | | 109 | |

| | | | | | | | | | | | |

Proxy Statement for the 20232024 Annual Meeting of Stockholders | Trimble 9

Executive Compensation Philosophy, Policies and Practices

Our executive compensation philosophy is based on our continuing effortobjective of attracting and retaining exceptional people and fosteringfostering and supporting a pay-for-performance culture. We have designed our executive compensation programsprogram to closely align with the interestinterests of our stockholders. A substantial portion of executive compensation is “at risk” based on our performance, with a significant weight toward long-term equity awards tied closely to stockholder returns and long-term objectives. Our executives are required to hold a minimum ownership level of our common stock and are prohibited from engaging in hedging or pledging activities with our common stock. Our compensation programs are designed without incentives to take excess risk, and executive compensation is subject to a “clawback” policy, which allows for the recovery of certain compensation in the event of a material restatement of our financial results or certain misconduct by an executive officer.

As discussed in detail under “Compensation Discussion and Analysis” later in this proxy statement, we provide only very-limited executive-only benefits, with no special pension arrangements or retirement plans (although we do have an Age & Service Equity Vesting Program, described therein). We provide no significant perquisites or other personal benefits for our executive compensation program provides short-term cashofficers, other than an annual executive physical exam, and long-term equity components, with a significant weight toward long-term equity awards tied closelyno tax reimbursements or “gross up” payments, other than related to stockholder returns and long-term objectives.standard relocation benefits.

Key Policies and Practices

The following summarizes some of our key executive compensation and related policies and practices:

| | | | | |

What we do |  What we don’t do |

•Use a pay-for-performance philosophy

•Maintain an independent compensation committee (our “People & Compensation Committee”)

•Retain an independent compensation advisor

•Review executive compensation and conduct an overall compensation risk assessment annually

•Place compensation “at risk,” with a majority of executive compensation in the form of performance-based incentives

•Maintain a stock ownership policy that requires our CEO and executive officers to hold a minimum ownership level of our common stock

•Maintain a “clawback” policy, which in the event of a material restatement of our financial results, allows for the recovery of certain compensation from our executive officers

•Hold an annual stockholder advisory vote on executive compensation

| •No executive-only pension arrangements or retirement plans (although certain eligible executives may participate in the Age & Service Equity Vesting Program as described below)

•No significant perquisites or other personal benefits for our executive officers, other than an optional company-paid annual executive physical exam

•No tax reimbursements or “gross up” payments, other than related to standard relocation benefits

•No hedging or pledging of our equity securities

•No stock option re-pricing

•No single-trigger change-in-control arrangements for equity issuances

|

Stockholder Engagement

Trimble’s Board values the opinions of our stockholders and carefully considers feedback received with regard to our governance practices, executive compensation program, and management of key ESG topics. Over the past several years, our management team has engaged with stockholders to better understand their views regarding our approach to executive compensation. In recent years, we have made changes to our executive compensation programsprogram in response to this input and based upon our ongoing review of best practices. These changes have included:

•Adopting a clawback policy, and updating the policy in 2023 to align with new rules regarding mandatory recovery of erroneously awarded compensation in the event of an accounting restatement, along with discretionary recovery of certain compensation in the event of misconduct leading to the need for an accounting restatement

•Eliminating all single-trigger full vesting in connection with new equity issuancesa change in control

•Increasing the stock ownership guidelines for the members of our Board and our executive officers

•Adding a “People & Planet” modifier to our executive long-term incentive program, with quantifiable strategic environmental and diversity goals

At our 20222023 Annual Meeting of Stockholders, we conducted aour annual non-binding stockholder advisory vote on the compensation of our named executive officers (commonly known as a “Say on Pay” vote). Our stockholders approved the Say on Pay proposal with 87.8%83.6% of the votes cast in favor of the proposal. As part of our ongoing investor engagement, our Investor Relations team and Chief Financial Officer engaged with stockholders to discuss topics of interest to them and to proactively provide key updates to them. The People & Compensation Committeefeedback gathered during these conversations helped inform the Board's thinking, in particular about compensation, governance and disclosure. Based on stockholder feedback, we will adjust our 2024 long-term incentive program for our executive officers to equally distribute the weighting on the performance restricted stock units granted in 2024 between relative TSR (total shareholder return), to ensure our outcomes are aligned to our peer group, and ARR (annual recurring revenue), to continue to drive outcomes aligned with our business results. We value the opinions of our stockholders and will continue to consider the outcome of future Say on Pay votes, as well as feedback received throughout the year, when making compensation decisions for our executive officers. We also regularly engage with our stockholders to discuss a variety of other issues, including our sustainability program and other key ESG topics.

10 Trimble | Proxy Statement for the 20232024 Annual Meeting of Stockholders

ITEM 1

Election of Directors

A board of ten directors is to be elected at the Annual Meeting. Steven W. Berglund, who has served as executive chairperson of the Board since January 2020 and a director since 1999, is not seeking reelection and will be retiring from the Board, and his executive role with the Company, effective as of the date of the Annual Meeting. The Company anticipates that Börje Ekholm, who has served as a director of the Company since January 2020, and previously served as a director of the Company from 2015 to 2017, will be named by the Board as its chairperson, to succeed Mr. Berglund in that role.

The Board has nominated the following persons to be elected to serve as directors until the next Annual Meeting of Stockholders and until their successors are duly elected and qualified. Each nominee has consented to being named as such in this proxy statement and to serving on the Board if elected. Each nominee except Mr. Painter is independent under the rules of the Nasdaq Stock Market (“Nasdaq”). A summary of the business experience and other information regarding each of the nominees is set forth on the following pages.

| | Name | Name | Age | Principal Occupation | Director Since | Name | Age | Principal Occupation | Director Since |

| James C. Dalton | James C. Dalton | 67 | Retired, U.S. Army Corps of Engineers | 2020 | |

| Börje Ekholm | 60 | President and Chief Executive Officer, Ericsson | 2020 | (1) |

| Ann Fandozzi | 51 | Chief Executive Officer, Ritchie Bros. | 2021 | |

| Börje Ekholm * | |

| Börje Ekholm * | |

| Börje Ekholm * | | 61 | President and Chief Executive Officer, Ericsson | 2020 | (1) |

| Kaigham (Ken) Gabriel | Kaigham (Ken) Gabriel | 67 | Chief Operating Officer, Wellcome Leap | 2015 | |

| Meaghan Lloyd | Meaghan Lloyd | 48 | Chief of Staff and Partner, Gehry Partners, LLP | 2016 | |

| Sandra MacQuillan | 56 | Retired Supply Chain Executive | 2018 | |

| Meaghan Lloyd | |

| Meaghan Lloyd | |

| Ronald S. Nersesian | |

| Ronald S. Nersesian | |

| Ronald S. Nersesian | | 64 | Chair of the Board of Directors, Keysight Technologies | 2024 | (2) |

| Robert G. Painter | Robert G. Painter | 51 | President and Chief Executive Officer of the Company | 2020 | |

Mark S. Peek * | 65 | Executive Vice President, Workday, Inc. | 2010 | |

| Mark S. Peek | |

| Mark S. Peek | |

| Mark S. Peek | |

| Kara Sprague | |

| Kara Sprague | |

| Kara Sprague | |

| Thomas Sweet | |

| Thomas Sweet | |

| Thomas Sweet | Thomas Sweet | 63 | Chief Financial Officer, Dell Technologies | 2022 | |

| Johan Wibergh | Johan Wibergh | 59 | Former Chief Technology Officer of Vodafone | 2018 | |

| Retiring: | |

| Steven W. Berglund | 71 | Executive Chairperson of the Company | 1999 | |

| Johan Wibergh | |

| Johan Wibergh | |

*Mr. Peek is currently the Board’s Lead Independent Director. Chairperson

(1)Mr. Ekholm was reappointed to the Board in 2020, having previously served as a director from 2015 to 2017.

(2)Mr. Nersesian was reappointed to the Board in 2024, having previously served as a director from 2011 to 2021.

Vote Required

Directors of the Company are elected by a plurality of the votes, under which the nominees receiving the highest number of “for” votes at the Annual Meeting will be elected as directors. In an uncontested election of directors, such as this, our majority voting policy will apply. Under our majority voting policy, if any nominee for director receives a greater number of votes “withheld” than votes “for”,“for,” the nominee must tender his or her resignation to our Board within five days following the certification of the election results and, within 90 days following the date of the Annual Meeting, the remaining members of our Board shall, through a process managed by the Nominating and Corporate Governance Committee and excluding the director nominee in question, determine whether to accept such resignation. (In a contested election, directors of the Company would be elected by a plurality of the votes, under which the nominees receiving the highest number of “for” votes at the Annual Meeting will be elected as directors.)

Abstentions and broker non-votes will be counted for purposes of determining whether a quorum is present, but not in determining the outcome of the election of directors.

Holders of proxies solicited by this Proxy Statementproxy statement will vote the proxies as directed or, if no direction is made, for the election of the Board’s ten nominees. In the event that any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for a substitute nominee designated by the present Board to fill the vacancy.

Recommendation of the Board of Directors

| | |

| The Board of Directors recommends that stockholders vote FOR the election of the above-named nominees to the Board of Directors. |

Proxy Statement for the 20232024 Annual Meeting of Stockholders | Trimble 11

| | | | | |

James C. Dalton Retired, U.S. Army Corps of Engineers

Member of the Nominating and& Corporate Governance Committee Other public boards:

None | Mr. Dalton served as the Director of Civil Works for the U.S. Army Corps of Engineers (USACE) from August 2016 until January 2020. In this position, he led, managed and directed the policy development, programming, planning, design, construction, contingency operations and emergency response, operation, and maintenance activities of the Army Civil Works Program, a $6 billion annual program of water and related land resources of the United States, and oversaw the work of over 25,000 civilian employees. He also represented the USACE in the United Nations’ Advisory Board High-Level Experts and Leaders Panel on Water and Disasters, and served on several national and international water resources Committees. From May 2007 until August 2016 he was Chief of USACE’s Engineering and Construction (E&C) Division, responsible for policy, program, and technical expertise in the design and construction programs for the U.S. Army, U.S. Air Force, Department of Defense, other Federal agencies, and over 60 foreign nations. He served as the Corps' South Atlantic Division and South Pacific Division Regional Integration Team (RIT) team leader, USACE Climate Change Adaptation Committee Chair, and lead for USACE on Resilience. Mr. Dalton was selected to the Senior Executive Service (SES) of the US Office of Personnel Management in January 2005. Mr. Dalton has held numerous other roles during his career with the U.S. Army Corps of Engineers, which he joined in 1978, including Regional Business Director for USACE’s South Atlantic Division in Atlanta, Georgia, Director of Business Management for the Gulf Region Division in Baghdad, Iraq, project manager for the Bosnia project to support Operation Joint Guard, and various engineer roles in Saudi Arabia as part of the Saudi Arabia construction program. Mr. Dalton received his B.S. in Architectural Engineering from North Carolina Agricultural & Technical State University and holds an M.S. in Civil Engineering from North Carolina State University. Qualifications: Mr. Dalton is qualified to serve as director of the Company because of his deep domain expertise in large-scale construction environments and his extensive experience in managing complex organizations as a result of his senior leadership positions within the USACE. Mr. Dalton’s background in overseeing complex, multibillion-dollar civil construction projects and managing personnel throughout the world, his government and multilateral policy advisory experience, and his experience with resilient and sustainable practices, particularly around water and land resource planning, bring a unique perspective to the Board. |

12 Trimble | Proxy Statement for the 20232024 Annual Meeting of Stockholders

| | | | | |

Börje Ekholm President and Chief Executive Officer, Ericsson

Member of the People & Compensation Committee (chair) Other public boards:

Ericsson | Mr. Ekholm has been president and chief executive officer of Ericsson, a multinational networking and telecommunications company, since January 2017. From 1992 to January 2017, he held various positions with Investor AB, an investment firm and holding company with controlling stakes in several large Swedish companies and smaller positions in a number of other firms. Mr. Ekholm's positions with Investor AB included: from May 2015 to January 2017, he was chief executive officer of Patricia Industries, a unit of Investor AB that includes its wholly-owned and partner-owned companies, as well as financial investments; from September 2005 to May 2015, he was president and chief executive officer of Investor AB; from 1997 to 2005, he was responsible for all private equity investment activities within Investor AB and was also head of Investor Growth Capital, Investor AB’s wholly owned venture capital arm; from 1995 to 1997, he founded and managed Novare Kapital, an early stage venture capital company owned by Investor AB; and from 1997 to 2015, he was also a member of Investor AB’s Management Group. Mr. Ekholm is a director of Ericsson, was previously a director of Alibaba Group (having retired from its board onin March 31, 2022), and within the past five years was previously a director of Nasdaq.Nasdaq (having resigned in May 2017). He also currently serves on the board of the Swedish American Chamber of Commerce New York. Mr. Ekholm has a Master of Business Administration from INSEAD, France and holds a Master of Science in Electrical Engineering from the KTH Royal Institute of Technology in Stockholm. Qualifications: Mr. Ekholm is qualified to serve as director of the Company because he brings a valuable combination of operational and financial management expertise, particularly in the areas of networking and telecommunications, through his experience as president and chief executive officer of Ericsson, and of venture capital, through his experience serving as president and chief executive officer of Patricia Industries and Investor AB, and manager of Novare Kapital. In addition, Mr. Ekholm brings management expertise from a diverse range of industries and organizations through his former service as chairman of the board of Nasdaq OMX and a director of Alibaba Group, Telefonaktiebolaget LM Ericsson and the KTH Royal Institute of Technology. |

| | | | | |

Ann Fandozzi

Chief Executive Officer, Ritchie Bros.

People & Compensation Committee

| Ms. Fandozzi is Chief Executive Officer of Ritchie Bros., the world's largest industrial auctioneer and a leading used equipment seller. Prior to joining Ritchie Bros. as CEO in 2020, Ms. Fandozzi was CEO of ABRA Auto Body and Glass from 2016 to 2019, and previous to that role, from 2012 to 2016, was CEO of vRide, a carpooling platform that works with private and public employers. Prior to these CEO roles, Ms. Fandozzi served in several executive positions for Whirlpool, DaimlerChrysler and Ford Motor Company. She served on the board of Pinnacle Foods, a publicly-traded packaged food company that was acquired by ConAgra, and is a board member of Ghost Robotics, a robotics start-up. Ms. Fandozzi is also a frequent speaker on technology, transportation, and green/environmental topics. Ms. Fandozzi holds a Bachelor of Science degree in Computer Engineering from Stevens Institute of Technology, a Master of Science degree in Systems Engineering from University of Pennsylvania and an MBA from The Wharton School of the University of Pennsylvania.

Qualifications: Ms. Fandozzi is qualified to serve as a director of the Company because of her extensive knowledge and experience as an innovative leader, spanning both relevant industrial end markets and an understanding of technologies that can transform the way those industries operate. Ms. Fandozzi’s engineering and analytical background, combined with her executive leadership experience, provide the Company a unique perspective on how to accelerate growth in industries through technology and transformational change, and insight into the drivers of customer value. Ms. Fandozzi’s experience as a speaker and advocate for environmental sustainability and diversity also informs and benefits the Company’s long-term sustainability strategy.

|

Proxy Statement for the 2023 Annual Meeting of Stockholders | Trimble 13

| | | | | |

Kaigham (Ken) Gabriel Chief OperatingExecutive Officer, Wellcome LeapPitt BioForge

Member of the Audit Committee Other public boards:

None | Dr. Gabriel is chief executive officer of Pitt BioForge, which will operate an advanced biomanufacturing facility being established by the University of Pittsburgh (Pitt), and is the founding director of Pitt’s Advanced Biomanufacturing Institute. From 2020 to 2023, Dr. Gabriel was the Chief Operating Officer of Wellcome Leap, an independent innovation organization funded by the Wellcome Trust, the world's fifth largest research trust. Wellcome Leap works at the intersection of engineering and life-sciences to deliver critical medical and healthcare capabilities at accelerated timescales. From 2014 to May of 2020, he was the president and chief executive officer of The Charles Stark Draper Laboratory, an independent not-for-profit research institution that develops innovative technology solutions in the fields of national security, space, biomedical systems and energy. Prior to that, Dr. Gabriel served as deputy director of the Advanced Technology and Projects (ATAP) group at Google from 2012 to 2014 and as corporate vice president at Google/Motorola Mobility. From 2009 to 2012, he was the deputy director, and then acting director, of the Defense Advanced Research Projects Agency (DARPA) in the Department of Defense. Between 2002 and 2009, Dr. Gabriel was the Co-Founder, Chairman and Chief Technology Officer of Akustica, a fabless semiconductor company that commercialized Micro Electro Mechanical Systems audio devices and sensors. Dr. Gabriel holds SM and ScD degrees in Electrical Engineering and Computer Science from the Massachusetts Institute of Technology. Qualifications: Dr. Gabriel is qualified to serve as director of the Company because of his strong background and experience in management in technology companies, including in his current and recentpast positions with Pitt BioForge, Wellcome Leap, and Draper Laboratory. Dr. Gabriel also brings deep technological expertise and knowledge of the industry to the Company. |

Proxy Statement for the 2024 Annual Meeting of Stockholders | Trimble 13

| | | | | |

Meaghan Lloyd Chief of Staff and Partner, Gehry Partners, LLP

Chair of the Nominating and& Corporate Governance Committee (chair) Member of the People & Compensation Committee Other public boards:

None | Ms. Lloyd is the chief of staff and a partner at Gehry Partners, LLP, a full service architectural firm with extensive international experience in the design and construction of academic, museum, theater, performance, and commercial projects. Founded in 1962 in Los Angeles, California, Gehry Partners’ mission is to raise architecture to the level of art, while creating buildings that meet the project’s functional and budgetary needs. She has held this position since 2009. Prior to this, she was a designer working with Frank Gehry in the firm. In addition to her duties at Gehry Partners, she served as chief executive officer of Gehry Technologies, Inc., a cloud-based software and service company for the architectural, engineering and construction sectors, from 2013 to 2014. Ms. Lloyd received her Bachelor of Science in Architectural Studies from the University of Illinois, Champaign-Urbana and her Master of Architecture from Yale University. She is a board member of Turnaround Arts California. Qualifications: Ms. Lloyd is qualified to serve as a director of the Company because she brings a valuable combination of operational and project management expertise, and because of her significant industry knowledge and experience in the areas of architecture, construction, and design from her work with Gehry Partners, LLP. |

| | | | | |

Ronald S. Nersesian Chair of the Board of Directors, Keysight Technologies Other public boards:

Keysight Technologies | Ronald S. Nersesian currently serves as non-executive chair of the board of Keysight Technologies, an electronic measurement company. He was executive chair of the board of Keysight Technologies from May 2022 through April 2023, having become chair of the board in 2019. Prior to becoming executive chair of the board in May 2022, he was president, chief executive officer, and a director of Keysight Technologies beginning in 2013, when Agilent Technologies announced the separation of its electronic measurement business and launched Keysight Technologies. From November 2012 to September 2013, he served as president and chief operating officer of Agilent Technologies. From November 2011 to November 2012, he served as Agilent Technologies’ executive vice president and chief operating officer. From March 2009 to November 2011, Mr. Nersesian served as president of Agilent’s Electronic Measurement group (EMG), and from February 2005 to March 2009, he served as the vice president and general manager of the Wireless Business Unit of EMG. Mr. Nersesian joined Agilent in 2002 as vice president and general manager of the company’s Design Validation Division. Mr. Nersesian began his career in 1982 with Computer Sciences Corporation as a systems engineer for satellite communications systems. In 1984, he joined Hewlett-Packard, and served in a range of management roles during his tenure. In 1996, Mr. Nersesian joined LeCroy Corporation as vice president of worldwide marketing and subsequently assumed other senior management roles, including senior vice president and general manager of the company’s digital storage oscilloscope business. He is also a member of Georgia Tech’s Advisory Board. Mr. Nersesian holds a bachelor's degree in electrical engineering from Lehigh University and an MBA from New York University, Stern School of Business. Mr. Nersesian previously served on Trimble’s board from 2011 to 2021. Qualifications: Mr. Nersesian is qualified to serve as director of the Company because of his strong business operational experience with technology companies and management expertise developed over three decades. This breadth of experience includes his recent service as president and chief executive officer of Keysight Technologies. Mr. Nersesian has extensive experience in managing and growing international technology enterprises, which is directly relevant and valuable to the Company. |

14 Trimble | Proxy Statement for the 20232024 Annual Meeting of Stockholders

| | | | | |

Sandra MacQuillan

Retired Supply Chain Executive

Nominating and Corporate Governance Committee

| Ms. MacQuillan was executive vice president and chief supply chain officer at Mondelez Global LLC, a multinational food and beverage company from May 2019 to February 2023. From 2015 to May 2019, she was senior vice president and chief supply chain officer at Kimberly-Clark Corporation, with responsibility globally for procurement, manufacturing, logistics, quality, safety, and sustainability. From 2009 to 2015, Ms. MacQuillan served as global vice president, supply chain for Global Petcare, a $15 billion business of Mars, Incorporated and was responsible for procurement, manufacturing, engineering, and logistics. During her tenure at Mars, she also served in a variety of operations and supply chain roles since joining the company in 1994. Ms. MacQuillan has extensive international experience in procurement, technology, and engineering, and has lived and worked in the UK, Czech Republic, Russia, Middle East, Belgium and now in the U.S. Ms. MacQuillan earned her bachelor's degree in mechanical engineering with honors from the University of Greenwich, UK and was awarded Chartered Engineer status from the Institution of Mechanical Engineers, London.

Qualifications: Ms. MacQuillan is qualified to serve as a director of the Company because of her extensive business operations experience, particularly in the areas of supply chain and logistics management, gained from her roles at several large multinational companies. Ms. MacQuillan also brings a strong international business perspective and broad domain knowledge and experience in procurement, technology and engineering.

|

| | | | | |

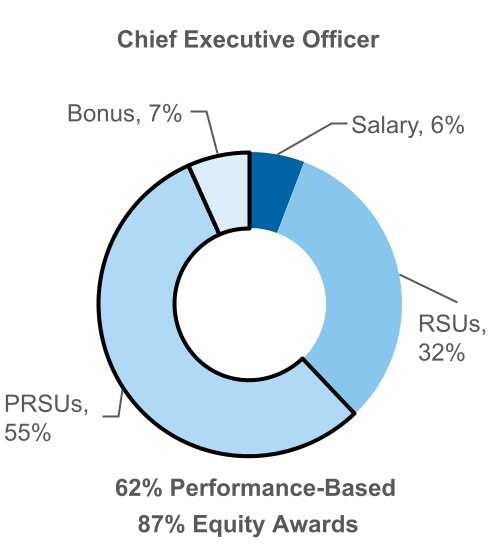

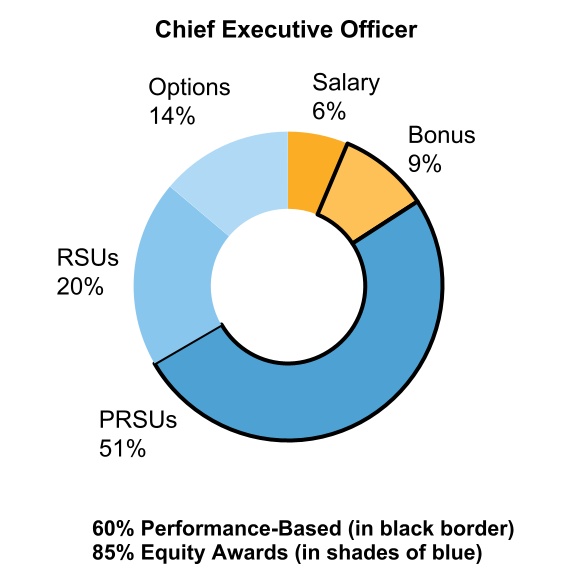

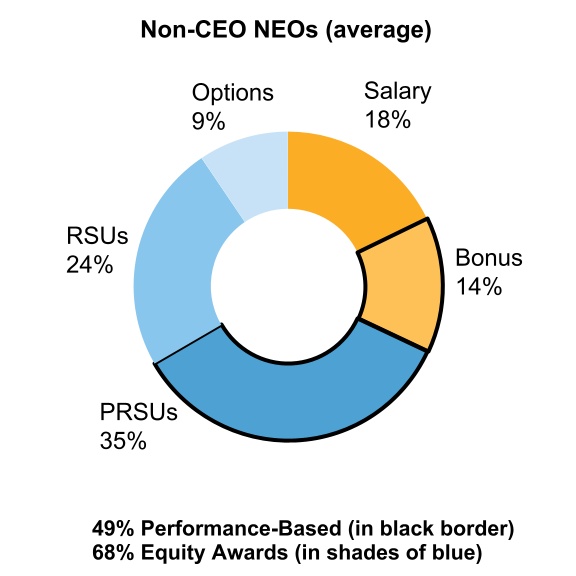

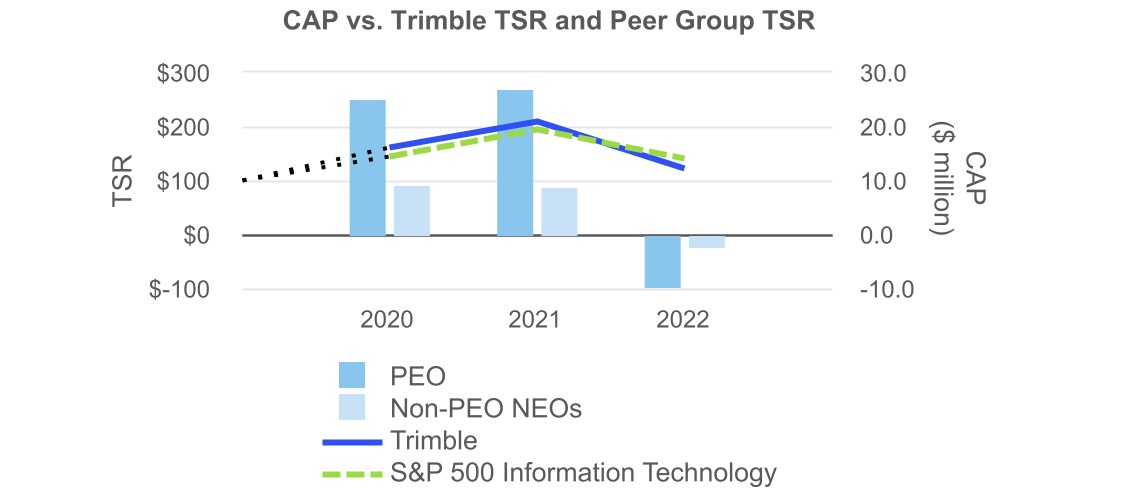

Robert G. Painter President and Chief Executive Officer of the Company Other public boards: